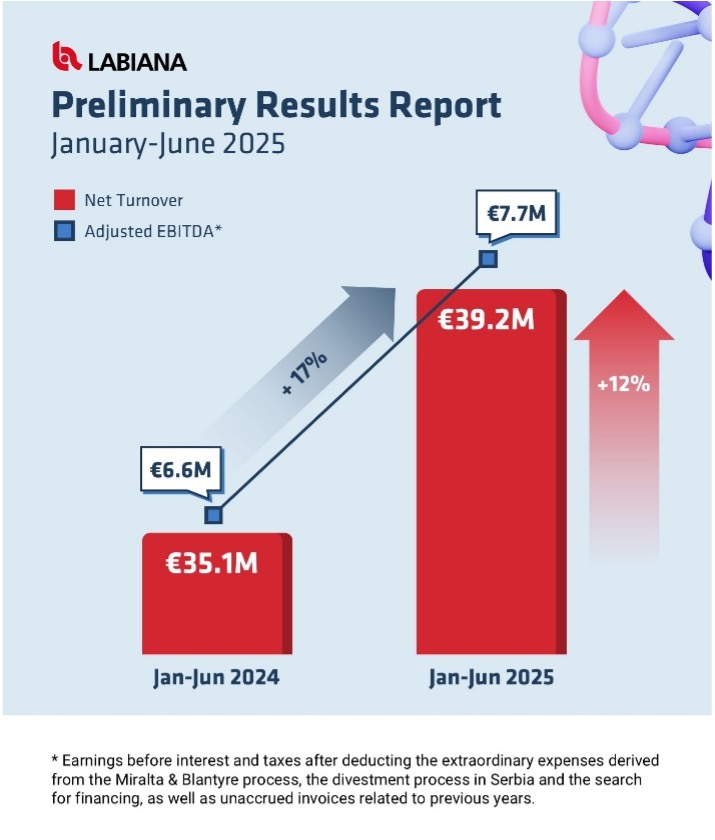

Labiana Health reports 17% growth in adjusted EBITDA and 12% in revenue

- The company closes H1 in 2025 with €7.7 million in adjusted EBITDA and €39.2 million in revenue, according to unaudited figures released on BME Growth.

- Labiana ended in 2024 with a share price increase of +136.80%, making it the best-performing company on BME Growth that year.

Madrid, August 4, 2025 – Labiana Health, the Spanish pharmaceutical group specializing in human and animal health, has published a communication through BME Growth, the Spanish alternative stock market where it is listed, disclosing an unaudited preliminary report on its consolidated financial results for the first half of the fiscal year in 2025.

Specifically, the company reports unaudited figures of €39.2 million in revenue and €7.7 million in adjusted EBITDA(*), representing year-on-year increases of 12% and 17%, respectively.

These figures reflect solid business performance, in line with Labiana’s strategic focus on margin consolidation, operational efficiency, and prioritization of key markets.

In a complex international environment, with varying demand dynamics across countries, Labiana has remained committed to quality, industrial innovation, and long-term service to its clients and investors. The company continues to execute its strategic plan with special attention to core markets such as Germany, France, Austria and the UK, where it maintains stable relationships with institutional investors and industrial partners.

The full consolidated financial report for the period January–June 2025, along with the auditors’ limited review, is scheduled for publication in October.

About Labiana

Labiana Health is a leading, independent and integrated international platform in the human and animal health industries, with a diversified portfolio of products and services and a broad base of long-standing top-tier clients.

The company operates subsidiaries in Spain, Turkey and Mexico, and two production centers in Spain. Products manufactured by Labiana are present in over 150 markets and have marketing authorizations in more than 100 countries. The group’s operations are structured around two complementary and differentiated business lines: contract manufacturing, which provides income stability and visibility; and development, manufacturing and marketing of own products, which supports growth.

In June 2022, Labiana Health joined the BME Growth market with an initial valuation of approximately €36.1 million and a reference share price of €5, becoming the first veterinary company to go public on BME Growth in Spain.

In 2023, Labiana recorded revenue of €58.5 million (+1.06% vs. 2022), and in 2024 its revenue grew by 13.3% to €66.26 million (+18.4% excluding the Serbian subsidiary divested in the same year). EBITDA for 2024 tripled, reaching €9.43 million.

In capital markets, Labiana was the best-performing stock on BME Growth in 2024, with a share price increase of +136.80%, reaching a market capitalization of approximately €21.37 million.

(*) Adjusted EBITDA: Earnings before taxes, financial expenses, depreciation and amortization, excluding extraordinary costs related to the Miralta transaction, the divestment of the Serbian subsidiary, financing-related advisory services, and non-provisioned invoices from previous years.

Leave a Comment